The monetized benefits associated with these health improvements were also used as input for modeling the overall economic impact of this plan.

Lower Energy Costs and More Jobs

The annual energy cost for a typical all-electric household with electric vehicles (EVs) is around $2,600 lower than the annual energy cost for a typical gas-heated household with gasoline-powered vehicles. The majority of these savings are due to the lower fueling costs of an EV as compared to a gasoline-powered vehicle. Savings for the all-electric household increase to around $4,000 annually compared to homes that are heated with oil or propane.

Consumers should keep these energy cost savings in mind when they consider the cost of purchasing vehicles and heating equipment. Marylanders who have already moved away from fossil fuels and gone all-electric not only enjoy lower energy costs but are also shielded from fossil fuel price fluctuations, which are highly variable and often influenced by geopolitical situations. This plan will help all Marylanders enjoy the benefits of living without dependence on fossil fuels.

Utility Rate Impacts

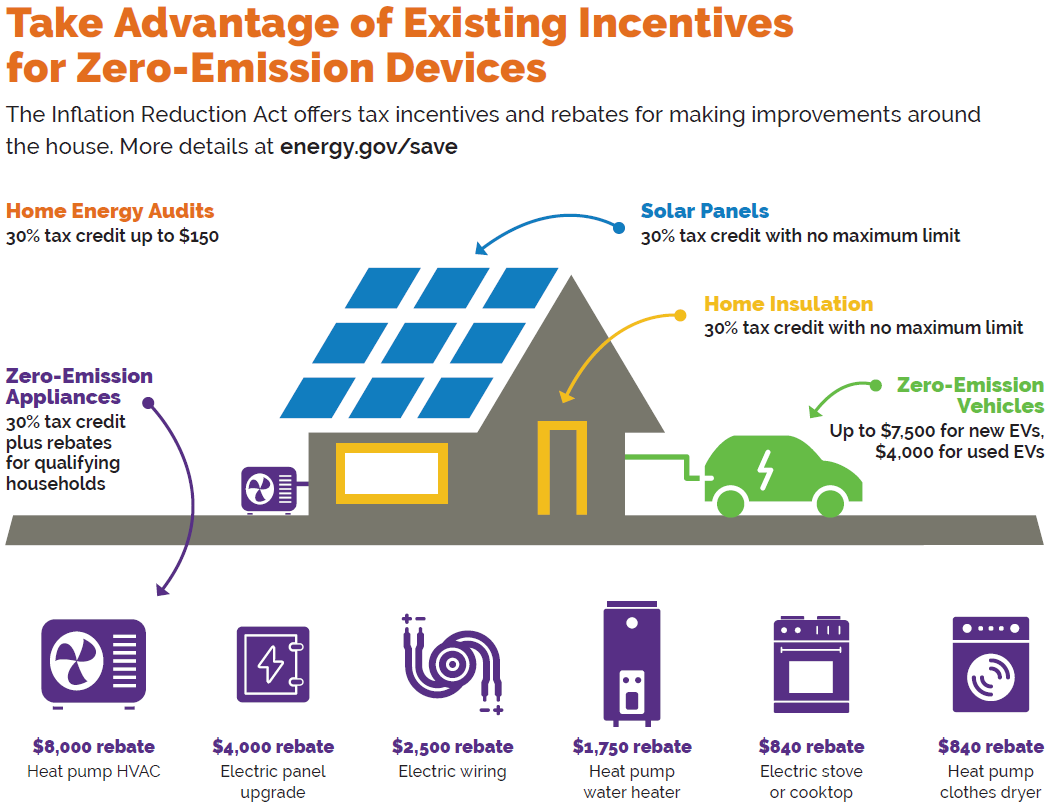

Electricity prices have historically been much less volatile and more predictable than natural gas, heating oil, and propane prices and that trend is expected to continue. E3’s 2021 Maryland Building Decarbonization Study projected that a high-electrification policy scenario that resembles the policies presented in this plan would have a minimal impact on electricity prices through 2050, increasing retail rates by just $0.01 per kilowatt-hour (kWh) per decade, relative to business-as-usual. Federal clean energy investments through the Bipartisan Infrastructure Law (BIL) and Inflation Reduction Act (IRA), which were authorized after the E3 study concluded, could further reduce electricity rates by increasing energy efficiency and efficient electrification. On the other hand, ongoing developments in PJM’s wholesale electricity markets and transmission planning operations could raise electricity prices in the near term. A revised electricity rate impact analysis will be run once the state’s new Clean Power Standard is developed. Ultimately, electric rates will be driven by utility investments to meet the needs of the state and are subject to PSC’s jurisdiction.

The cost of natural gas utility service has risen dramatically over the past few years for two reasons. First, gas utilities have significantly increased spending on their distribution infrastructure. Second, after a decline during the early years of widespread hydraulic fracturing, gas commodity costs have also risen while becoming more volatile. Gas utility rates are expected to continue to increase significantly over the coming decades. In every scenario that E3 modeled for the Maryland Building Decarbonization Study, gas rates doubled or more by 2035.

Policies such as a Clean Heat Standard could put additional upward pressure on natural gas rates if fossil fuel companies pass their cost of compliance on to their customers. However, the rate impacts of the new policies in this plan are expected to be less than the savings that gas customers will see if natural gas utility companies are directed to scale back plans to rebuild their gas distribution systems. One study shows that if gas utility companies decreased gas system capital investments by 75% relative to projected spending - a reduction that is consistent with a transition away from fossil fuels in the building sector - then gas customers would save approximately $22 billion between 2025 and 2045. That level of savings could more than offset the rate impacts of new policies presented in this plan. These possible impacts highlight the need for comprehensive gas planning, which is currently being considered by the PSC.

Electricity System Impacts

One often-discussed factor that can influence electricity rates is the buildout of the electricity grid to handle periods of system peak demand, when overall consumer demand on the grid is the highest. The electricity grid is constructed to handle peak demand and, to the extent that peak demand increases, then additional investments may be needed to increase grid capacity.

Studies show that electrification paired with energy efficiency and load flexibility can lessen growth in peak demand. E3’s Maryland Building Decarbonization Study found that Maryland’s grid will shift from summer to winter peaking around the end of this decade and peak demand will grow very gradually through 2045 with efficient electrification.

A study by the Lawrence Berkeley National Laboratory (LBNL) found similar results when looking at the impact of electrification policy on large buildings in Maryland. LBNL found that MDE’s Building Energy Performance Standards (BEPS) regulation, due to its combination of energy efficiency and emissions standards, is modeled to decrease peak electricity demand for covered buildings by 6% by 2040, whereas a hypothetical BEPS policy that excludes energy efficiency standards would increase peak demand by 24% by 2040. LBNL’s findings are especially relevant in the context of E3’s study, which found that commercial building electrification has a larger impact on peak demand growth than residential building electrification. In other words, because BEPS is modeled to decrease, not increase, peak demand, there is even more confidence that peak demand impacts from residential electrification can be similarly managed through the state’s new policies.

The CSNA directed PSC to conduct a study “assessing the capacity of each company’s gas and electric distribution systems to successfully serve customers under a managed transition to a highly electrified building sector” including the following requirements for this study:

Use a projection of average growth in system peak demand between 2021 and 2031 to assess the overall impact on each gas and electric distribution system;

Compare future electric distribution system peak and energy demand load growth to historic rates;

Consider the impacts of energy efficiency and conservation and electric load flexibility;

Consider the capacity of the existing distribution systems and projected electric distribution system improvements and expansions to serve existing electric loads and projected electric load growth; and

Assess the effects of shifts in seasonal system gas and electric loads.

The draft results of the study performed by the Brattle Group were provided to PSC’s Electrification Study Work Group in November 2023, and a final report is due by the end of 2023. The following is a summary of the draft results:

In aggregate, Maryland’s electric systems would see a load growth in the range of 0.6-2.1% per year through 2031 under a high electrification scenario assuming utility energy efficiency plans consistent with the CSNA and existing demand response plans.

The Maryland electric system, which is currently summer peaking, would switch to winter peaking around 2026-2027.

Pursuing policies to incentivize efficient electrification, such as using cold climate heat pumps and load flexibility measures, could result in significant mitigation of load growth by 2031 to 0.2-1.2% compound annual growth per year.

Historically in Maryland, there was significant load growth in the 1980s of 4.9% per year and more moderate growth of 1.2-1.5% from 1990 to 2010. Load declined between 2010 and 2020.

These results show that peak load growth through 2031 with high electrification of the building sector will be comparable to or less than the growth rate the Maryland system has seen over the past 40 years.

The studies mentioned above by Brattle, E3, and LBNL highlight the importance of energy efficiency and peak-shifting measures to mitigate electric system costs as electrification proceeds. These studies also show that the policies in this plan can be implemented while growing the electric system at rates below historic levels.

Technology Development and Deployment

Most of the technologies that are needed to transition to a clean energy economy are not only readily available but they are also the most popular. Renewable energy started being built faster than new fossil fuel power plants in the U.S. in 2014. Heat pumps started outselling gas furnaces in the U.S. in 2022. The best-selling car in the U.S. in 2023 was an EV. The transition is well underway and manufacturers are producing zero-emission devices fast enough to meet demand. Installing all of these new devices requires the work of skilled technicians. Expect continued job growth for electricians, heat pump installers, renewable energy installers, and professionals involved with developing, financing, and managing small and large infrastructure projects.

Some of the technologies that are part of the transition - including electrolyzers for hydrogen production, vehicle-to-grid electronics, industrial heat pumps, and networked geothermal systems - are available today but not at the scale that is needed for the future. Expect job growth related to developing, manufacturing, and installing these and other emerging technologies.

Technologies that are necessary to achieve net-zero emissions - including carbon capture and storage (CCS) and direct air capture (DAC) - need rapid development to be deployed in time for Maryland to hit its goals. Expect job growth related to research, development, manufacturing, and installing these emerging technologies. Modeling for this plan shows that CCS and DAC would need to start being deployed within the next 10 years and that DAC would need to pull around 10 MMTCO2e out of the air in 2045 for Maryland to achieve net-zero emissions within the state. This challenge is not unique to Maryland; other reports show that CCS and DAC are necessary technologies for the world to achieve net-zero emissions.

Clean Energy Jobs and Workforce Development

The Maryland Department of Commerce’s Office of Strategic Industries and Entrepreneurship is focused on the growth and development of the state’s strategic industry sectors. The energy sector is a target sector for growth, and Commerce’s staff includes an Energy Program Manager dedicated to supporting the industry. Commerce has two primary areas of focus for growing the energy industry sector and supporting the creation of jobs:

Encouraging the formation and growth of clean energy startups and technology development – Innovation in the clean energy sector is one way to grow the industry and spur job creation in Maryland. Commerce works directly with clean energy entrepreneurs and startups to connect them with resources to support their growth. Specifically, Commerce administers the Innovation Investment Tax Credit program, which fosters the growth of Maryland's technology sectors by incentivizing investment in early-stage companies to increase the number of companies developing innovative technologies in Maryland, increasing overall investments in current and emerging technology sectors, and increasing the number of individual investors actively investing in Maryland technology companies.

Business attraction – Commerce actively works to attract clean energy companies to Maryland. Commerce attends several clean energy conferences throughout the year, meeting with companies to pitch Maryland as a location of choice for new business investment. Commerce has several incentive programs available to support the attraction of clean energy jobs to the state, including Advantage Maryland conditional loans, More Jobs for Marylanders tax credit program, Job Creation tax credit program, and Partnership for Workforce Quality workforce training grants.

In December 2021, PSC awarded offshore wind renewable energy credits to two developers who will build off the coast of Maryland. In the decision, PSC attached conditions to the approval that included that developers create a minimum of 10,324 direct jobs during their development, construction, and operating phases of their offshore wind projects. To foster the development of a workforce to support the emerging offshore wind industry, the Department of Labor developed a strong talent pipeline through the Good Jobs Challenge grant. The nearly $23 million grant supports both entry-level and mid-level training programs to grow and sustain the state’s offshore wind workforce.

By investing in high-quality, locally led workforce systems with training in manufacturing, transportation, logistics, and skilled trades, the Maryland Works for Wind program creates and upskills electricians, carpenters, ironworkers, and many other jobs needed for the clean energy transition. With emerging technologies in mind, training programs continue to enhance their curriculum to meet the demands for offshore wind. Upon completion of the grant, over 3,800 individuals will have benefited from a workforce development program related to offshore wind and placed into high-quality jobs.

The Department of Service and Civic Innovation (DSCI) was established by the Serving Every Region Through Vocational Exploration (SERVE) Act of 2023 to promote service and volunteerism in the state of Maryland. The Act also called for the creation of the Maryland Climate Corps to “conserve and restore State and local parks and engage in other climate or environmental projects.” In addition to coordinating with existing conservation programs already working in the state, DSCI will work with other state agencies to:

Prepare Marylanders for high-demand climate jobs - Maryland's first of a kind service-to-career pathways (Maryland Corps and Service Year Option) emphasize exposure and skills required for green jobs of the future. In the SERVE Act, the climate is listed as a call-out area to ensure that members are placed in roles aligned with high-demand jobs aligned with the needs of Maryland. The DSCI’s service programs will help to recruit, train, and retain talent in careers in the clean energy sector.

Partner to braid funding streams to meet shared climate and workforce goals - The Maryland Climate Corps is an opportunity for interagency collaboration between DSCI and partner state agencies to braid state and federal climate, workforce, and service funds to create workforce pathways for frontline communities into the green jobs of the future. Potential federal grant funding can be braided with existing service and AmeriCorps funding streams to maximize climate workforce preparation.