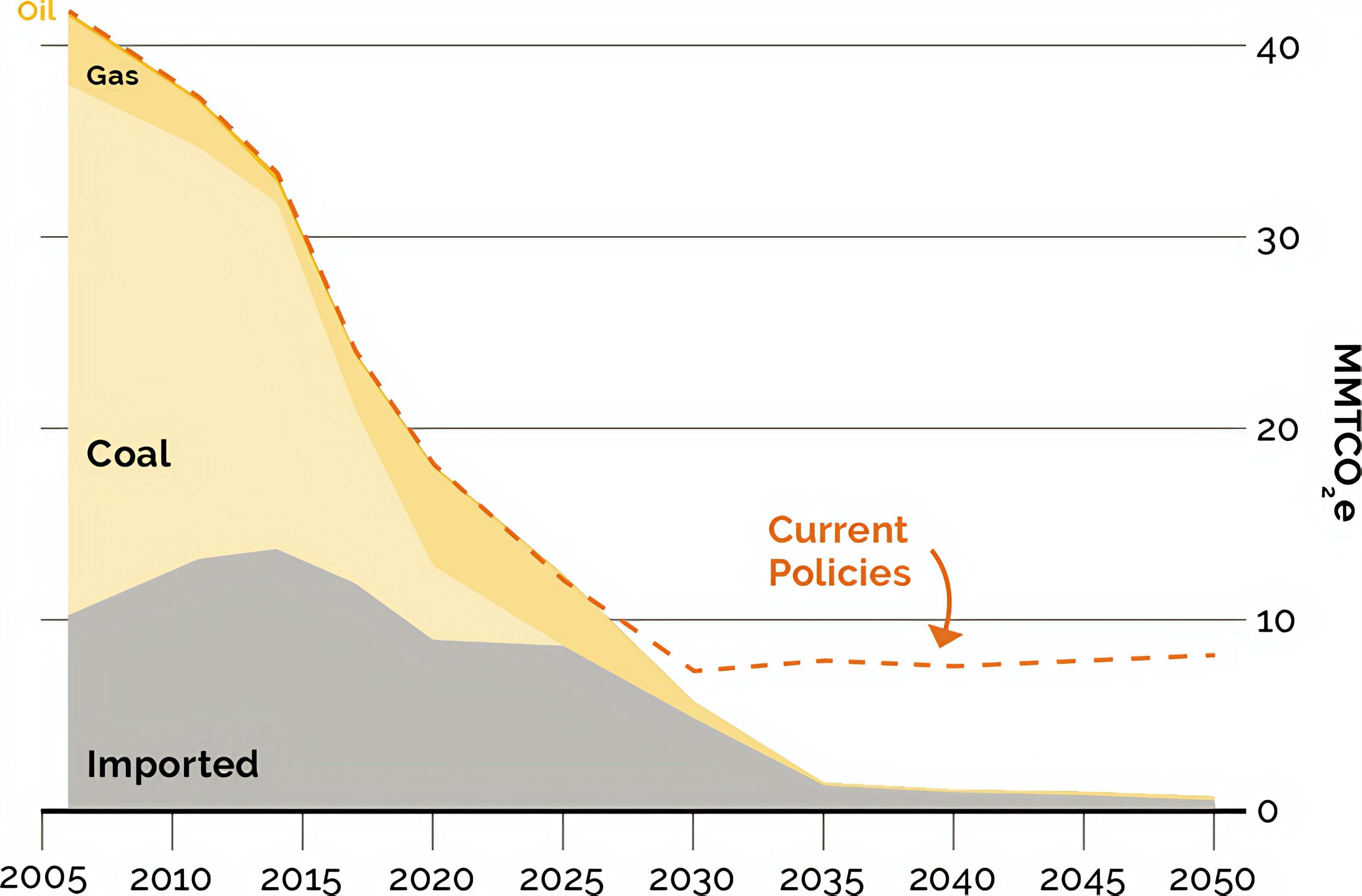

Figure 3: Maryland’s electricity sector GHG emissions trends, historical and projected, from 2006 to 2050 based on current and new policies

In 2020, electricity consumption accounted for 21% of Maryland’s gross GHG emissions.10 While this may seem like a large amount, the electricity sector has made significant progress since 2006, when it accounted for 35% of emissions. The GHG reductions in this sector can be attributed to programs that reduce total electricity demand, programs aimed at reducing the carbon intensity of the electricity consumed, and wholesale electricity market trends, including the large-scale replacement of coal-fired power plants with cleaner sources of electricity.

Reduced energy demand results from energy efficiency and conservation, which is driven in Maryland by the EmPOWER Maryland program,11 building energy codes and standards, and other policies. To reduce the carbon intensity of the electricity generated, the state relies on the Renewable Portfolio Standard (RPS)12 and other clean energy initiatives to incentivize renewable energy generation. In addition, RGGI and other pollution control programs reduce carbon dioxide (CO2) emissions from fossil fuel-fired energy generation, also impacting the carbon intensity of the electricity.

The combination and interaction between these programs lowers the emissions intensity of both in-state electricity generation and imported electricity. To achieve deeper reductions in emissions from the electricity sector, Maryland intends for 100% of the electricity consumed in-state to be clean by 2035. This goal will be achieved through the deployment of grid-scale and rooftop solar panels, offshore wind, hydropower, nuclear power, and energy storage technologies that incorporate load flexibility and dispatchability into the electric grid as sectors electrify to create a more manageable system. Additionally, new statewide transmission and distribution infrastructure must be built while existing infrastructure is updated to enhance the electric grid, improve the efficiency and delivery of electricity, and facilitate the integration of renewable energy with a priority on clean resources. Ultimately, emerging technologies in the electricity sector must be identified and evaluated to develop solutions for zero-emission dispatchable technologies to meet demand and maintain reliability.

Reaching Maryland’s clean energy goals is made easier with incentives funded through the Inflation Reduction Act (IRA)13. The Renewable Energy Production Tax Credit is an IRA-funded program providing a per kilowatt-hour tax credit for electricity generated by solar and other qualifying technologies for the first 10 years of a system’s operation. The Investment Tax Credit reduces federal income tax liability for a percentage of the cost of an eligible renewable energy system that is installed during the tax year.

Importantly, the IRA also expanded the eligibility for these tax credits, so they can now be utilized by tax-exempt entities and local governments through direct pay provisions, by homeowners installing rooftop solar or residential wind systems, and by more traditional commercial entities. Both tax credits also receive bonuses for domestic content and siting in an energy community.

Renewable Portfolio Standard (current, modified)

Maryland’s Renewable Portfolio Standard (RPS) requires Maryland electric suppliers to provide increasingly large proportions of Maryland's electricity from renewable energy sources like solar, wind, hydropower, and qualifying biomass.14 The program is implemented through the creation, sale, and transfer of Renewable Energy Credits (RECs). The current RPS goal is for 52.5% for non-municipal utilities and 20.4% for municipal utilities of Maryland's electricity to come from renewable sources by 2030 through increases in solar power, deployment of new offshore wind energy off the Atlantic coast, and geothermal energy.

To effectively decarbonize Maryland’s electricity supply, the state intends to increase the deployment of clean and renewable energy resources through the RPS and other clean energy initiatives while reducing CO2 emissions from energy generation through RGGI and other pollution control programs. Maryland’s 2030 Greenhouse Gas Emissions Reduction Act (GGRA) Plan advanced measures to accelerate the deployment of clean energy that have not been enacted, including a proposed Clean and Renewable Energy Standard (CARES), to achieve 100% clean electricity in Maryland by 2040.15 The 2030 GGRA Plan projected substantial increases in the rate of clean energy deployment as a result of those measures and a coincident decrease in fossil fuel-fired generation. Maryland will need to increase its deployment of clean energy resources to reach the projections in this plan and achieve the new goal of a 60% reduction in statewide GHG emissions by 2031. This plan calls for the CARES proposal to be replaced with a Clean Power Standard that would achieve 100% clean electricity by 2035, as described later in this chapter.

The state is not meeting the RPS goals and more challenges remain. Maryland has seen setbacks to deploying solar and wind energy for various reasons, namely delays in offshore wind development and siting and supply chain issues creating impediments to solar development. The achievement of changes in Maryland’s generation mix will be impacted by the federal agencies that oversee the power markets from which Maryland procures electricity. A backlog of projects awaiting approval by the PJM Interconnection, the regional transmission organization in which Maryland participates, has contributed to the issue.

Offshore wind will be a reliable clean energy resource available to the state. The Maryland Offshore Wind Energy Act of 2013 created an offshore wind carveout of Tier 1 resources under the RPS of a maximum of 2.5% of electricity sold in Maryland in 2017, and later.16 The Clean Energy Jobs Act (CEJA) added a second round of offshore wind procurement for a minimum of an additional 1,200 megawatts (MW) with a residential cap of annual bills to protect ratepayers.17 The Maryland Public Service Commission (PSC) has approved four major wind projects to be built more than a dozen miles off the Maryland coast between the first and second rounds of applications.

To support the growth of a healthy offshore wind industry, the state must continue to work with neighboring states, federal agencies, and local municipalities to design and deploy offshore and onshore transmission systems to integrate the large number of offshore wind projects anticipated in the waters of the East Coast. To do so, Maryland will continue to lead in the discussions of the Regional SMART-Power partnership with other coastal states.

Under the CEJA and through the SMART-Power partnership, Maryland aims to expand education and training programs to grow a new offshore wind workforce, expand local supply chains, support the redevelopment of and improvements to critical port infrastructure, and advance research and innovation. In addition, Maryland will work with the U.S. Department of the Interior Bureau of Ocean Energy Management to explore the expansion of offshore wind lease areas in federal waters.

Under this plan, RPS will continue to require that approximately 50% of electricity consumed in Maryland will be generated by renewable sources by 2030. RPS will also link with a new Clean Power Standard to achieve the Administration’s goal for 100% of the electricity consumed in-state to be clean by 2035. This plan calls for the definitions of qualifying resources in the RPS program to align with definitions of clean power resources under the forthcoming Clean Power Standard, including the elimination of eligibility for municipal solid waste incineration. Legislation will be needed to change the RPS definitions, which are set in the state’s statute.

POWER Act (current)

The Promoting Offshore Wind Energy Resources (POWER) Act became effective June 1, 2023.18 The POWER Act sets a state goal of reaching 8,500 megawatts (MW) of offshore wind energy capacity by 2031 and anticipates the issuance of sufficient wind energy leases in the central Atlantic region to satisfy that goal. Offshore wind can provide clean energy at the scale needed to help achieve Maryland’s economy-wide net-zero GHG emissions reduction goal. The POWER Act intends to upgrade and expand the transmission system to accommodate the buildout of at least 8,500 MW of offshore wind energy from qualified projects and maximize the opportunities for obtaining and using federal funds for offshore wind and related transmission projects.

PSC, in consultation with MEA, is required by the POWER Act to request that PJM Interconnection analyze specified offshore wind transmission system expansion options. Either the PSC or PJM must issue and evaluate competitive solicitations for proposals for related projects. The PSC may then accept one or more proposals, subject to specified criteria.

Additionally, the POWER Act provides an alternative procurement mechanism to finance the remaining space in the original two lease areas owned by Orsted and US Wind. Through that procurement approach, the Maryland Department of General Services (DGS) must issue a procurement and may enter into at least one long-term power purchase agreement for up to 5 million megawatt-hours annually of offshore wind energy. Round 1 and 2 offshore wind developers may apply to PSC for a full or partial exemption from the requirement to pass along certain federal benefits to ratepayers.

Energy Storage Act

(current)

The Energy Storage Act of 2023 established a goal for Maryland to have 3,000 megawatts of energy storage by 2033. Energy storage devices include thermal storage, electrochemical storage, virtual power plants, and hydrogen-based storage. The law requires PSC to implement a Maryland Energy Storage Program to cost-effectively procure energy storage over the next decade. PSC issued Order No. 90823 on October 2, 2023, initiating a workgroup to develop a Maryland Energy Storage Program and docketed Case No. 9715 to develop this program.

Community Solar Act

(current)

The Community Solar Pilot Program was established in 2015. This pilot program limited overall community solar capacity to 583 megawatts, including 52.5 megawatts dedicated for low and moderate income (LMI) customers, which amounted to only a small percent (<5%) of the state’s electricity load.19

House Bill 908 of 2023 passed with the Governor’s signature making the Community Solar Program permanent. It requires community solar projects constructed under the permanent program to dedicate 40% of energy output to LMI subscribers. In addition, House Bill 908 removes the cap on the amount of community solar capacity that Maryland can deploy, constraining it only by the state's statutory net energy metering limit of 3,000 megawatts.

PSC is implementing the permanent program through its Net Energy Metering Workgroup and upcoming rulemaking. PSC discusses the current state of Community Solar and Net Metering in its Net Metering Report, which is filed annually with the Maryland General Assembly.

Regional Greenhouse Gas Initiative (current, modified)

RGGI is a collaborative program among 11 East Coast states to reduce CO2 emissions from power plants through a regional cap and invest program. These states adopted market-based CO2 cap and invest programs designed to reduce emissions from fossil fuel-fired electric power generators with a nameplate capacity of 25 megawatts or greater.

Thanks to its success, RGGI has grown substantially in recent years, with New Jersey renewing its participation in the program in 2020, Virginia joining in 2021, and Pennsylvania proposing regulations in 2022 to begin participation.20

RGGI is currently composed of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia. Participating RGGI states require fossil fuel-fired electricity generators to have acquired, through a regional auction or secondary market transactions, one CO2 allowance for every short ton of CO2 emitted over a three-year compliance period.

Maryland has participated in RGGI since the program’s inception in 2007. Through RGGI, the participating states have cut power plant emissions in half while enjoying billions of dollars of economic benefit and creating thousands of jobs.

As a RGGI participating state, Maryland caps and reduces CO2 emissions from in-state fossil fuel electricity generators. The 2030 GGRA Plan identified the expansion of the RGGI partnership to additional states, especially Maryland’s neighbors in PJM territory, as a priority measure to reduce the emissions intensity of Maryland’s imported power.

RGGI has successfully welcomed new members to the program in recent years, substantially improving its coverage of the PJM region and dramatically improving the impact on carbon pollution in the region, including cleaning

Maryland’s imported power. RGGI states largely recognize that all participating states can benefit from a broader market with more participants. Larger markets increase economic efficiency and cost-effectiveness, align more closely with the regional nature of the PJM transmission grid and can help drive even greater consumer savings.

RGGI participating states reinvest the proceeds from the quarterly CO2 allowance auctions in consumer benefit programs to improve energy efficiency and accelerate the deployment of renewable energy technologies. Maryland allocates proceeds from the sale of CO2 allowances into SEIF - a special, non-lapsing fund administered by MEA. MEA deploys SEIF funds to promote affordable, reliable, and clean energy across Maryland’s diverse regions and communities while reducing energy bills, creating jobs in growing industries, helping to reduce GHG emissions, increasing resiliency, and promoting energy independence.

RGGI sets a binding cap on CO2 emissions from power plants in the region that reduces every year. The 2030 GGRA Plan proposed to reduce the RGGI cap to zero by 2040, with cost controls. Due to Maryland’s new statewide GHG emissions reduction requirements and the historic investments made by the federal government in clean energy development, Maryland has upped its ambition for RGGI. In the current RGGI Program Review process, where the RGGI participating states convene to establish the program’s future goals, Maryland is now advocating for the RGGI cap to be strengthened to be consistent with states’ 100% clean energy goals. The participating states are expected to reach an agreement on a new program structure in 2024. If the outcome of the multistate agreement is not sufficiently stringent to meet the goals of the Climate Solutions Now Act, MDE will consider additional complementary regulations.

MDE, which enforces Maryland’s regulations for RGGI participation, will also eliminate underutilized components of the program including offsets and the Limited Industrial Exemption Set Aside when it updates its CO2 Budget Trading Program regulation in 2024.

Clean Power Standard

(new)

To achieve Governor Moore’s commitment to achieve 100% clean power by 2035, strengthen Maryland’s status as a climate leader, and support the goal of reducing statewide GHG emissions, the Administration and state agencies are developing a Clean Power Standard (CPS).

CPS is a policy that will complement the RPS to ensure that all electricity consumed in the state is generated by clean and renewable sources of energy by 2035. Although the policy is still in development, it will likely allow for solar, wind, hydro, nuclear, energy storage, and other zero-emission technologies to qualify as clean energy sources, while eliminating existing eligibility and subsidies for municipal solid waste incineration.

MEA, MDE, the Maryland Department of Natural Resources (DNR) Power Plant Research Program (PPRP), the Maryland Public Service Commission (PSC), and the Office of People’s Counsel (OPC) will determine the best approach to a potential rulemaking. The state agency partnership will design requisite components, timing, and milestones for outcomes of a potential regulation, including responsible agency; designing supportive and/or complementary policy; identifying the relevance of existing and proposed federal policy; and identifying key stakeholders for their perspectives on a potential rule framework.

The partnership will also address any economic and ratepayer impact. Ideally, a CPS would have minimal impact on electricity rates and promote public and private investment within the state. The goal is to design a program that mitigates potential ratepayer impacts, ensuring that existing inequities are remediated while stimulating economic growth within the state. Challenges related to generation deployment within the RPS will likely apply to CPS implementation as well.

CPS, as modeled for this plan, would avoid annual GHG emissions of 0.9 MMTCO2e in 2031, and 2.5 MMTCO2e in 2045.

State Incentives for Renewable Energy

(current)

Over the years, Maryland has hosted a wide range of incentives to encourage the new development of renewable energy projects. The Maryland Clean Energy Center (MCEC) provides public-private and public-public partnerships, including through leading Commercial Property Assessed Clean Energy (C-PACE),21 the Maryland Clean Energy Capital Program (MCAP),22 and the Clean Energy Advantage (CEA) Loan Program.23 The state also administers the Maryland Energy Storage Income Tax Credit Program and the Maryland Solar System Sales Tax Exemption.24 Local governments have created Green Banks, Finance Authorities, and Energy Conservation Tax Credits.

One of the primary entities responsible for incentivizing renewable energy is MEA, which manages various renewable energy programs under SEIF using revenue from RGGI and RPS alternative compliance payments, which are incurred when insufficient RECs are available to meet the RPS requirements, as well as other targeted non-SEIF renewable energy funds. Through grants, rebates, loans, technical assistance, and education efforts, MEA is actively advancing solar, offshore wind, land-based wind, and geothermal heating and cooling in Maryland. The eligibility per program varies and may include individual homeowners, private businesses, municipal, local, and state governments, and nonprofit organizations.

In Fiscal Year 2022, MEA hosted the following solar programs: the Solar Resiliency Hubs Grant Program, Solar Canopy and Duel Use Technology Grant Program, the Community Solar

Low-to-Moderate Income Power Purchase Agreement Grant Program, the Community Solar Guaranty Grant Program, the Public Facility Solar Grant Program, the Low-Income Solar Grant Program, and the Solar Technical Assitance Program. The Clean Energy Rebate Program also provided incentives to residential and commercial customers to install solar photovoltaic (PV) systems, as well as solar water heating, geothermal heating and cooling, and wood and pellet stoves. The Offshore Wind Program includes the Capital Expenditure Program and the Workforce Training Program, funded both by SEIF and the Offshore Wind Business Development Fund, thereby providing support for research and building a supply chain.

Impact of Electricity Sector Policies

The new policies are modeled to reduce electricity sector GHG emissions by 128.9 MMTCO2e between now and 2050. The societal benefit of this level of emissions reduction is estimated to be $29 billion. Figure 3 illustrates the change in GHG emissions from this sector based on historical and modeled trends.

13 White House. Inflation Reduction Act Guidebook.

14 Public Service Commission. Renewable Energy Portfolio Standard Program.

15 The Maryland Department of the Environment. 2030 GGRA Plan.

16 The Maryland Energy Administration. Offshore Wind Energy in Maryland.

17 Maryland Senate Bill 516. Clean Energy Jobs.

18 Maryland Senate Bill 781. Offshore Wind Energy - State Goals and Procurement (Promoting Offshore Wind Energy Resources Act).

19 The Maryland Energy Administration. Maryland Community Solar. https://energy.maryland.gov/Pages/MarylandCommunitySolar.aspx.

20 Pennsylvania’s program is currently on hold pending litigation.

21 Maryland Clean Energy Center. MDPACE.

https://www.mdcleanenergy.org/finance/md-pace/.

22 Maryland Clean Energy Center. Maryland Clean Energy Capital Program.

https://www.mdcleanenergy.org/finance/mcap/.

23 Clean Energy Advantage.

https://cealoan.org/.

24 The Maryland Energy Administration. Maryland Energy Storage Income Tax Credit - Tax Year 2023.

https://energy.maryland.gov/business/Pages/EnergyStorage.aspx.